UBS USA CHAIRMAN HOEKSTRA OUT MCCANN IN, UBS USA FOR SALE

Associated Press reports: “Swiss investment bank UBS AG said Tuesday it has named former Merrill Lynch & Co. executive Robert McCann as CEO of its U.S. wealth management unit, replacing Marten Hoekstra … The Internal Revenue Service had originally tried to force Zurich-based UBS to turn over names of some 52,000 American clients believed to be hiding nearly $15 billion in assets. … he (McCann) was president of global wealth management at Merrill Lynch … McCann had been picked to lead the banks’ (Merrill Lynch) combined brokerage unit, but instead left the same month the deal was completed. … McCann will oversee UBS’s U.S. and Canadian wealth management business as well as any international business that is booked in the U.S.” L1 UBS AG made secret overtures to both Morgan Stanley and Merrill Lynch to sell them UBS USA. Both disclosed to the media the UBS AG attempt which further marginalize UBS USA credibility. McCann was instrumental on putting “lipstick on the pig” before the shotgun marriage of Merrill Lynch to Bank of America. Reliable UBS sources say he is suppose to do the same with UBS USA before sale to another from either Asia or Middle East. His job is to clean up controversial matters at UBS USA crannies allegedly like UBS Utah Industrial Bank and its lawyer Craig Darvin’s office. It is no secret UBS AG wants out of US regulations strangling its profits as well as Swiss credibility with UHNW (ultra high net worth) clients. UBS cannot compete with the Washington insiders like Goldman Sachs. UBS AG will be a stock to own just before the sale is known, thanks to the astuteness of UBS AG Chairman Kaspar Villiger.

SWISS ATTEMPT OECD CONTROL TO CENSURE UBS AGENDAS

Financial Times reports: “Switzerland has long been a part of the Organization for Economic Co-operation and Development (OECD), but it has found membership of the so-called club of rich countries quite uncomfortable of late. After all, legendary bank secrecy has come under heavy attack from other OECD members – notably France and Germany, let alone the G20 clampdown on tax havens. Under intense international pressure, however, the Swiss have now changed their tune and are keen to show “good citizens’ of the global community. … What better way than campaigning for the chairmanship of the OECD’s annual ministerial meeting next spring? The country chairing this meeting determines the agenda and can to some extent influence the outcome.” L2 UBS is very controversial and considered an open pandora’s box within European community. European’s are saying: “Why cannot we get tax cheats from UBS like Washington is doing.” It just shows UBS considers the European community too weak to demand such things of Switzerland.

LONDON CITY CATCHES UBS IN IMPROPER TRADING

Financial Times reports: “The Financial Services Authority levies the penalty against the Swiss bank for failing to stop employees from making unauthorised trades that cost customers almost £26m.” L3 Is UBS an international criminal network in and of itself?

EX-UBS MAN FINED AND BARRED IN INDIA

Financial Times reports: “An ex-UBS investment adviser has been fined £35,000 and banned from holding sensitive finance industry posts in the first of what is expected to be several individual misconduct cases stemming from the bank’s former India private client desk. … for helping to cover up a scam that cost UBS $42m (£25m) in compensation after staff used customer money to hide losses from unauthorised trading. … The bank’s India operations have spawned a separate investigation by the Indian government’s Enforcement Directorate, which has been probing whether what it terms “unspecified parties” violated foreign exchange transactions by misusing accounts in London.” L4 We just do not know what is going on at UBS. This is a definite example of UBS policy of blaming incentivised individual UBS employees for internal UBS policies. Time and time again incentivised UBS employees get caught. They are then on their own.Release: Is UBS USA a threat to national security?

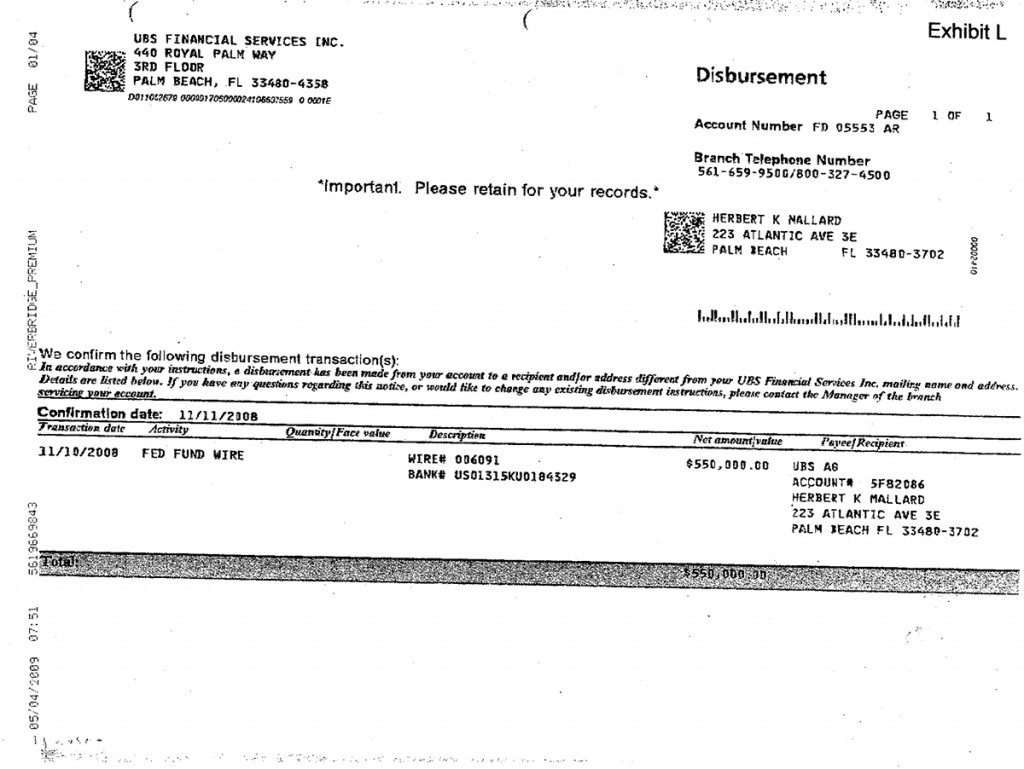

These are crossover shifting documents. US Federal Government requires that all shifting of client account assets must be client authorized in writing. UBS has “in accordance with your instructions” on the documents to make it look like they are complying with US Federal Government regulations when in fact they never got written authorization for Exhibits K & N or L in Issue 10. UBS transfers deliberately and illegally broke the laws of the US by their actions. They have done so while on US probation. Under the Department of Justice agreement UBS must report their criminal malfeasance. To date neither the Utah Court nor UBS has complied.

SENIORSAVIOR.COM NEWS RELEASE

Story hook: Querying UBS submitting unverified identification and addresses to IRS on credit line and mortgage agreements, a Utah Department of Financial Institutions officer callously said: “What’s an out of place number?” UBS senior citizen Client replied: “What was an out of place 9/11 box cutter?” UBS Utah Industrial Bank in the shadow of the proposed NSA secret complex has been determined a probable threat to international security. US Department of Treasury wants to shut down all Utah Industrial Banks (Exhibit CC). Let us explain in more detail.

UBS senior citizen Client has been an acclaimed investigative journalist/author residing in both Washington and London. He is quite familiar with the entwine of various governments and media. His recent October presence as a speaker on UBS USA Weil/Hoekstra/Darvin matters in Europe was considered vital to international security (Exhibits AA & BB) and was a contributing factor in the recent termination of UBS USA Chairman Hoekstra. It is believed Plaintiff UBS Utah Industrial Bank lawyer Craig Darvin is still employed with UBS. Reliable UBS sources say Craig’s office is allegedly implicated in implementing the UBS Utah Industrial Bank scheme of fabricating IRS credit line, mortgage and other documents both for and against UBS national and international clients. These fraudulent documents are then submitted for Utah Court processing to legitimize their authenticity. Let us explain in a bit more detail.

Below and attached are an overview of what has transpired for the past year within Salt Lake City, Utah 3rd District Court scrutinized case # 080926075. Seniorsavior (These are primarily retired judges, attorneys and media executives dedicated to assisting Florida senior citizens.) has been tracking UBS for some time with the use of secondary news source internalrevenue.com. One primary purpose is to expose the fraudulent behavior of the controversial UBS Utah Industrial Bank within Utah. We have documents and reliable sources proving beyond any reasonable doubt the fraudulent activities of the UBS Utah Industrial Bank jeopardizing the national security of the US. We find it ironic that Utah Senator Orin Hatch as senior Senate Intelligence Committee member brought home the pork with the planned Salt Lake City NSA behemoth building complex. This is now in jeopardy. How can Utah contractors build such a building when a few miles away UBS Utah Industrial Bank is jeopardizing US international security? Let me just give you a brief chronology of events.

A forthright UBS AG Chairman Kaspar Villiger recently ordered UBS USA (Villiger correspondence will be available allegedly after Craig Darvin and other UBS USA internal matters are resolved.) to divulge the proper credit line agreement part and mortgage document successfully concealed from discovery. This original 5 of 5 credit line agreement and the contrary 13 page 3rd District Court accepted sworn UBS Utah Industrial Bank Chief of Credit Stewart affidavit (credit line agreement part pages 1-13) alleged fabricated credit line part agreement are obviously genuine material facts. At this time 3rd District Court is not about to admit complicity in routinely accepting UBS Utah Industrial Bank fraudulent Federal documents as “true and correct” over assertions of others.

1. UBS Financial Services gave a 5 of 5-page Client credit line part of a credit line/mortgage agreement (Exhibit Y) to IRS, as mandatory.

2. When Client and his real estate law firm queried UBS mortgage department in New Jersey they came upon an alleged crime scene of UBS USA destroying documents and purging the entire department in expectation of a Swiss government bailout.

3. After heated arguments between UBS Industrial Bank lawyer Craig Darvin and Client Florida real estate lawyers Alley, Maass, Rogers & Lindsay (Exhibit F), UBS Financial Services unilaterally sold Client account assets to shut down the credit line/mortgage agreement. Client was in France September and October 2008 during these episodes and had no knowledge of any UBS or Alley Maass, Rogers & Lindsay actions.

4. UBS USA went after the Client’s other UBS controlled assets via crossover shifting accounts between various UBS companies without the Federally regulated mandatory written authorization from an unknowing Client (Exhibits K & N). One of the shifting was cross border to a secret numbered Swiss account (Exhibit L also issue 9, internalrevenue.com). There are presently no past documents illustrating the whereabouts of these account assets.

5. UBS Utah Industrial Bank in a prepayment penalty action allegedly fabricated a second credit line agreement part adding 8 pages (Exhibit M) to allow 3rd District Court of Salt Lake City, among other things, false venue over the Client. These alleged fabrications were sworn to be “true and correct” in a 3rd District Court, Salt Lake City, Utah affidavit given by UBS Utah Industrial Bank Chief of Credit Steve Stewart. Besides the 8-page fabrication, there was unverified personal information. This included a non-existent UBS Client address (Exhibit Y) and two social security (Exhibit Y & UU) numbers as being true and correct. Federal law requires all credit line and mortgage agreements be verified and submitted to the IRS, especially names and addresses. This was never done either by UBS Financial Services or UBS Utah Industrial Bank.

6. UBS Utah Industrial Bank has abused their special relationship with the 3rd District Court of Utah and thus made all Utah Industrial Banks suspect. Despite repeated requests, the 3rd District Court of Utah has refused to give an authenticated credit line agreement part to Client for fear of being more culpable in writing. The 3rd District Court of Utah has allowed New Jersey and Utah lawyers to successfully dispute the UBS Client Florida mortgage in the 3rd District Court of Utah without either a Florida legal license or real estate license to do so. The 3rd District Court of Utah then made judicial determinations in favor of the New Jersey and Utah lawyers based upon this malfeasance. 3rd District Court of Utah is about to give a Summary Judgment saying none of the above mentioned issues are material existing facts submitted UBS Client, even though UBS has submitted two credit line agreements (Exhibits M & Y). This makes all Utah Industrial Banks and their special relationship with 3rd District Court of Utah judicial system suspect.

7. We decided to see how far this behavior went in jeopardizing the Utah Industrial Bank system. We made a UBS Utah Industrial Bank complaint to the Utah Department of Financial Institutions. They refused to recognize the fraudulent fabrications, any violations of Federal regulations, false Stewart “true and correct” mandatory IRS submissions et al. They considered the fraudulent behavior as well as violations of Federal law by UBS Utah Industrial Bank a civil matter (Exhibit AA). This makes all Utah Industrial Banks, Utah judiciary as well as the Department of Financial Institutions suspect.

You may peruse the case #: 080926075 in the 3rd District Court, Salt Lake City, Utah to obtain a larger panorama by reading what has been submitted to public record. We will assist you with documents and statements from our reliable sources, especially those working for UBS. We will be more than willing to give you email or telephone capabilities with those involved, other than our UBS reliable sources afraid of retribution. We must keep in mind that during the UBS Congressional hearings UBS witnesses demanded the anonymity accorded Mafia witnesses.

If there is interest, we will transmit the exhibits via email at once. We look forward to hearing from you by using info@seniorsavior.com

IS UBS UTAH INDUSTRIAL BANK SCAMING THE SYSTEM?

New York Times reports: “Utah is the nation’s unlikely capital of industrial banks … The Obama administration argues that the banks pose a threat to the economy because their parent companies can engage in risky practices but are often exempt from routine scrutiny by the Federal Reserve. Treasury officials want to require the corporate owners of the nation’s 41 industrial banks to accept more rigorous regulation or be forced to sell or shut them down. … The industry is deploying lobbyists, jawboning lawmakers, doling out campaign contributions and trying to persuade Treasury and banking officials. … In Salt Lake City, the banks have been a welcome presence. They created an estimated 15,000 jobs at the banks and related service companies, and their executives have sprinkled money around to everything from the Utah Symphony Orchestra to housing for the poor.” L5 We have UBS Industrial Bank Chief of Credit Steve Stewart allegedly perjuring himself in sworn documentation successfully submitted to the UBS 3rd District Court. UBS Industrial bank spreads money around their environs to lobbyists, political operatives and an occasional cultural event. This keeps the Utah local judiciary and other Salt Lake City folks happy while processing UBS US client victims transported from other states. It sort of reminds one of the train cars of Auschwitz (UBS) victims arriving to (3rd District Court) music. Reliable UBS sources say this processing of UBS client victims has been going on unnoticed by the Federal Government for years and is a big local moneymaker. We are partly responsible for bringing UBS Utah Industrial Bank transparency to Federal scrutiny.

UBS UTAH PORTAL TO INTERNATIONAL CRIMINALS, SPIES AND TERRORISTS NEXT TO NSA TOP SECRET COMPLEX — FOR A PRICE!

Salt Lake Tribune reports: “Utah’s construction economy will get a huge boost … when ground is broken on a new National Security Agency Data Center at Camp Williams next year, according to construction sector officials. The NSA … new center, a 1-million-square foot venture that will cost nearly $2 billion to build, according to budget documents.” L6 Utah Senator Orin Hatch as senior member of the Senate Intelligence Committee was instrumental in obtaining the contract. The only thing wrong is that the Utah UBS Industrial Bank a few miles away has allegedly become a portal into the US for international criminals, spies and potentially terrorists. This has been accomplished by their special relationship with the 3rd District Court of Salt Lake and the Utah Department of Financial Institutions (UDFI), which regulates the controversial UBS Utah Industrial Bank. 3rd District Court and UDFI provide rubber stamp sanctity to UBS Utah Industrial Bank malfeasance through the deaf ear and blind eye plausibility of denial scenario. Why would the US intelligence allow such a breach of US national security with a sensitive “top secret” NSA intelligence building nearby?

UTAH INDUSTRIAL BANK SHUT DOWN!

Salt Lake Tribune reports: “Obama is calling for the elimination of industrial bank charters and wants them all shut down within five years. If successful, the president’s plan could deal a hammer blow to Utah’s economy, which is the home of 25 industrial banks that employ thousands of the state’s residents and hold assets valued in excess of $168 billion. … Although Ed Leary, commissioner of the Utah Department of Financial Institutions, pointed out the administration’s plan is only preliminary and there is not yet any legislation before Congress. Nevertheless, he said, the proposal was disheartening. ‘It is discouraging they would want to eliminate a charter [for industrial banks] that has never caused problems and didn’t contribute to any of the country’s financial problems,’ Leary said.” L7 It is hard to believe the Obama Administration for political reasons is going to allow UBS Utah Industrial Bank anti-US clients to mill around the NSA complex construction site for 5 years. Why is Washington committing US troops to far off lands when terrorists, spies, criminals et al can obtain fabricated UBS Utah Industrial Bank 3rd District Court processed documents in the shadow of the planned NSA complex?

FINANCIAL ADVISOR THOMAS G. HICKS III GETS CAUGHT IN UBS HONEY POT TRAP

Dow Jones reports: “A Utah trial court sided with Hicks in July, 2008, overturning the arbitration panel’s award. But in February, an appeals court reinstated the original $1.6 million award that Hicks (Thomas G. Hicks III) had been ordered to pay to UBS. … The forgivable loans are secured by promissory notes, so that if brokers leave, voluntarily or involuntarily, before the term is up, they have to repay the remainder of the bonus. … Sometimes advisors leave shortly after joining a firm because they don’t meet production hurdles and are pushed out by management. Other times, they leave when promises made by management during the recruitment process aren’t fulfilled.” L8 Thomas G. Hicks III was caught in a similar UBS alleged honey pot trap as the Florida UBS senior citizen client we have covered. UBS “incentivised” Hicks with a bonus, used his clients and then demanded the initial “incentivization” back. UBS also uses “incentivization” to manipulate client victims account assets without authorization.

UBS ASSISTANT GENERAL COUNSEL CRAIG DARVIN INTERMINGLES UBS OUT-HOUSE LAWYERS

“New Jersey Lawyer Anthony Borrelli of Riker, Danzig Scherer Hyland & Perretti represents UBS as out-house lawyer in Utah Supreme Court case Hicks v UBS #20100186 located on the 5th floor in Salt Lake City. AJ Borrelli was also allegedly instrumental in transporting a Florida senior citizen with clinical dementia into the 3rd District Court under UBS v Mallard case #080926075 on the 4th floor. This case is regarding an alleged UBS Florida credit line/mortgage prepayment penalty. Both cases have been occurring at the same time on different floors in the Salt Lake City Courthouse. There seems to be a question as to whether or not the Utah 3rd District Court did any vetting by not allowing Due Process in the UBS v Mallard case. UBS v Mallard publicly recorded court documents located on the 1st floor could have a bearing upon the outcome of the Hicks v UBS case, if Hicks is allowed to know.” (Seniorsavior.com) The reason why seniorsavior.com mentioned the floor whereabouts within the Salt Lake City Court is to show the close proximity and interrelationship between Court officers. The Utah processing efficiency relies upon unknowing clients, out-house lawyers and handsomely sustained Courthouse lawyers surrounding the Courthouse . This is a very tight and profitable Salt Lake City operation uneventfully reported before by media.”

UBS NEW JERSEY AND UTAH LAWYERS ALLEGEDLY NOT VETTED BEFORE UTAH SUPREME COURT

“Under the alleged direction of UBS Utah Industrial Bank in-house lawyer Craig Darvin; out-house Morristown, New Jersey lawyer Anthony (a.k.a. AJ) Borrelli; Salt Lake City, Utah lawyer Thomas Karrenberg et al allegedly represent UBS Utah Industrial Bank in an alleged honey pot credit line/mortgage contract trap (UBS v Mallard, case # 080926075) within the 4th floor Utah 3rd District Court. Allegations of United States Postal Service mail fraud, obstruction of justice, false unverified Federally mandated client contract identification, unauthorized on-shore (see above) and offshore shifting of client account assets (Issue 9) as well as other United States Federal violations have been asserted against UBS. Investigators looking into the unregulated Utah Industrial Banks and their special relationship with the Utah Courts have determined a pattern of behavior concluding with many startling revelations” There are more than 67 Exhibits from the UBS v Mallard Utah 3rd District Court case # 080926075 for Thomas Hicks III in Utah Supreme Court case # 20100186 to use, if his Utah lawyers will tell him.

Thomas G. Hicks III was caught in a similar alleged UBS honey pot bonus trap. Hicks has spent a considerable amount in fees bleakly pursuing justice within Utah courts against UBS. Hicks started with Utah arbitration firstly, Utah 3rd District Court secondly, Utah Court of Appeals thirdly and now Utah Supreme Court fourthly. Investigators have never found a case within the 5th floor Utah Appeals Court archives located on the 1st floor that has not been in favor of either UBS or Lehman on a technicality when pursuing their out-of-state clients dubiously dragged to the Utah court venue. Without allegedly being properly vetted, the same above mentioned UBS lawyers having allegedly committed malfeasance within the 4th floor Utah 3rd District Court UBS v Mallard case 080926075 are representing UBS within the 5th floor Utah Supreme Court Hicks v UBS case # 20100186. This is a classic rendition of the bigger lie theory. All involved have to tell bigger lies to cover their actions. This will be embarrassing to the Utah Supreme Court who have recently been apprised via United States Government registered mail. The Utah Supreme Court has acknowledged the problematic situation that was allegedly inserted within the Utah Supreme Court Hicks v UBS case # 20100186 files. There is no room for plausibility of denial, mistake or inadvertence.”

Letters to the Editor:

Dear Editor:

I heard also that our Senator Menendez abandoned his Florida citizen constituents in order to collect high fees lobbying for UBS and other banks that he assisted against our interests. I guess you would call this a XXX.

Miami Senior Citizen

Editor:

One seniorsavior.com elderly judge called my Dad at his law firm. Dad looked at your web site and asked me to find more on my computer. Dad didn’t want to use his ——— Law Firm computer because they would ask questions. He believes all external communications are watched at Utah law firms. I asked Dad if he had done any of the evil things to elderly Americans in the 3rd District court. He said “no comment” and then said yes but he was not proud of it. He said ——– Law Firm made him do it and those involved control things in Salt Lake City. I feel sorry for Dad because we pray at the Tabernacle and live by our religion. My friends and myself are going to go undercover and tell the other kids about your site and what is going on. We will report back to you on what we find from their parents. I think a lot of the parents are afraid of these things and just go long with it. Don’t tell my name or my Father might get hurt.

J from SLC

Dear Sir:

Your inlandrevenue newsletter was brought to my attention by my barrister when he realised the importance to me. My Grandfather was the last Viceroy to India from the United Kingdom. Upon his passing he left me with a considerable estate. I was young and vulnerable to predators, as your wonderful newsletter refers to them. I happened to be solicited by UBS through my London accountant. I put 200,000 (pounds = $325,000US) into my new UBS London account. Months later I went to find the disposition of my account and found only 20,000 (pounds = $32,500US) left. Mind you, this was strictly a bank account. When I beckoned UBS to give me my account documents they would not give them to either my barrister or me. It seems my account, as you delightfully say, was “shifted” and could not be justified. It was terribly difficult for me because I was given no documents from the beginning to show this skullduggery. I often have wondered if UBS made this a habit. I now read about your courageous Florida senior citizen fighting UBS back. It must be difficult in the States to do this since we hear in our media of the rampant corruption we are presently witnessing. I will be delighted to give a statement of my experiences signed by my barrister.

A very noble woman

Dear Editor:

I saw Senator Orin Hatch write a Hanukah song for Jews and then call us “chosen”. It is a bit naive of the Senator to do this since Jews all know that when they hear such word, harm is not too far behind. In all do respect to the Senator, he should be looking at the UBS Utah Industrial Bank evildoers against senior citizen victims rather than trying to get the Jewish vote for Governor Romney’s presidential campaign. I believe both Romney and Hatch are not among The 12 in the Mormon Church.

NYC Attorney

Please Sir:

This probably will not be published by your one sided newsletter. UBS has been a good citizen in Florida and should not be reprimanded for customary financial service practices. We try. You also do not mention the good works we do for the Florida communities by donating our time and money. Why not read our brochures and report on our good works?

UBS Florida Financial Services Adviser

Dear Editor:

We enjoy your professional newsletter very well. I’m writing on behalf of our boutique law firm because we see you have fiduciary confidentiality capability for your “reliable sources”. It’s worse than you think, but not all Salt Lake City attorneys are like those you describe. In fact, the more religious in SLC won’t participate in the systemic looting of US citizens shipped in from elsewhere. The senior citizen victims are hit very hard. Florida seniors like the one’s you talk about are a prime food source for the predatory 3rd District Court associated lawyers. 3rd District Court is like a sham processing center with a few local cases brought in to make it look judicial. Several years ago Lehman Brothers Utah Industrial Bank brought in New Yorky type lawyers getting in on the racket. Things have been out of control with greed ever since. It’s difficult to go to our Tabernacle and see those judicial figures involved praying. We’re giving you a few malfeasance perpetrated upon the likes of the Florida senior victims. We see the Judge and UBS Utah Industrial Bank lawyers going in for the kill without any discovery allowed the Florida senior victim. He has even been denied a clear and true copy of the contract. It sounds like his lawyer made the prescribed judicially orchestrated abandonment of his action at the 11 hour. The first thing the judge will do is send Minutes dated 3 to 4 days before the Postal stamp. This way they severely cut down the response time of the victim. We gave you a list of those things the 3rd District Court does/allows that could be considered RICO material. You are on the right track. We pray for you so that we may be given the righteous path again.

SLC attorneys

Dear Readership:

Racketeer Influenced and Corruption Organizations Act (RICO) has been used in the past successfully. A Financial Company and a few of its lawyers were convicted do to our initiation. We allegedly have similar but more blatant issues with UBS Utah Industrial Bank that is solely foreign owned by UBS AG of Switzerland. UBS is already on United States Department of Justice probation but has failed to report their continued violations of Federal law, especially in Salt Lake City, Utah. We have accumulated more than enough documentation to cast the wide RICO net.

UBS Utah Industrial Bank natural special relationship with the 3rd District Court, Salt Lake City, Utah is well known by Utah lawyers. Utah Department of Financial Institutions regulators have alleged gone beyond the limits of just a normal “good old boy” interrelationship. We have seen a Commissioner Sutton become a hired lobbyist for UBS and other Utah Industrial Banks. All three have ignored the Federal UBS violations, which should have been reported to the Qualified Intermediary UBS Federal parole authority. What is remarkable is all have willingly documented this collaboration. They have become so brazen that they feel impervious to any and all US Federal Laws. UBS Utah Industrial Bank activity has put the entire Utah Industrial Bank scheme under Federal scrutiny. The other RICO prosecutions were comparatively difficult compared to the evidence accumulated in Utah. The Washington political operatives accepting $ from UBS may obfuscate an investigation but the media and EU will make things as transparent as possible. We already know most of the players. We do not know the extent of the UBS PAC $ in Salt Lake City, Utah. Like a Mafia Don, we do know UBS Utah Industrial Bank spreads good will contributions around their Salt Lake City neighborhood to keep the locals happy. One only has to look up fugitive from US Department of Justice UBS Chairman Raoul Weil upon the internet and see indelibly etched revelations are occurring. As recognized journalists, we are corresponding with media and internet defense teams to counter any reprisals for our investigative reporting.

Seniorsavior is currently investigating UBS Utah Industrial Bank’s special relationship with the 3rd District Court. They have interviewed approximately 75 Utah lawyers with varied but startling results. They are continuing their investigation and will be presenting their summary. Due to the huge “Letters to the Editor” response from especially Utah readership, we have decided to remain with explosive issue 12 for the foreseeable future. The revelations do not bode well for other Utah Industrial Banks. UBS Utah Industrial Bank will most probably be used as the poster bank targeted by the Department of Treasury as a broken system.

info@seniorsavior.com