USA ATTORNEY GENERAL HOLDER GIVES UBS IMMUNITY FROM PROSECUTION

Rolling Stone reports: “Apart from a few low-level flunkies overseas, no individual involved in this scam that impacted nearly everyone in the industrialized world was even threatened with criminal prosecution. … Covington & Burling, the onetime private-practice home of both Holder and Breuer. …assistant attorney general who had balked at criminally prosecuting UBS over Libor because, he said, ‘Our goal here is not to destroy a major financial institution.’ … ‘But when the attorney general says, ‘I don’t want to indict people,’ it’s the Wild West. ‘There’s no law.’ This is corruption at the molecular level of the economy, Space Age stealing – and it’s only just coming into view.” A1 According to the USA Attorney General Holder and his assistant Breuer, UBS has the right to continue converting Florida elderly client assets at will without fear for UBS has USA Justice Department immunity from prosecution. It will be difficult to surmount USA Justice Department immunity from prosecution given UBS. UBS and fellow conspirators have diverted the Gardiner Island Family approximately $147,000,000 estate to their use, control and ownership through wills/trusts manipulations. A UBS Palm Beach salesman is now living in Eunice’s furnished home. A UBS Palm Beach Client has had approximately $1,350,000 UBS unilaterally shifted and offshored. A Palm Beach real estate owner had approximately $2,000,000 allegedly converted by UBS. As UBS client victims continue to come forward, we will report their statements without the use of their names or identifying markers unless consented. We are professional journalists with fiduciary relationship responsibilities to our reliable sources.

USA ATTORNEY GENERAL HOLDER MISREPRESENTS THE TRUTH, AGAIN

Reuters reports US Attorney General Holder says: “No individual, no company is above the law. We don’t investigate companies based on who a CEO is, but we don’t avoid investigating companies based on who the CEO is, either,” A2 USA AG Holder’s statement blatantly contradicts the above Rolling Stone article. Holder is on record within our issues as giving UBS and UBS hierarchy immunity from prosecution. USA AG Holder’s UBS immunity is causing havoc with UBS Florida elderly clients easy prey for a USA criminally immune UBS.

WHAT HAPPENED TO EUNICE GARDINER’S MORE THAN $50,000,000 IN MUNICIPAL BONDS ALLEGED IN UBS CONTROL?

Politico reports: “Financial giant UBS has tangled with government regulators at the Securities and Exchange Commission, recently settling a dispute over fraudulent municipal bond gains.” A3 The questionable “UBS Trust Company NA (Netherlands Antilles), Co-Trustee of Eunice “Joyce” Gardiner Terminating Trust, U/A Dated June 10, 2011, as Amended” is now in charge of Eunice Gardiner’s unknown remaining estate. Netherlands Antilles recently has changed its laws benefiting the likes of UBS at the detriment of UBS Clients. Eunice was under mind altering medication for cancer of the ovaries. Eunice was to die a few days after UBS and Gunster put the above and other complex documents in front of Eunice to sign. A severely medicated Eunice was under intense pressure from these UBS, a UBS live-in salesman and Gunster Yoakley lawyers for wills/trusts signings during her last weeks of her life. Among other things but not necessarily all, Eunice’s live-in salesman and a Gunster lawyer wrote themselves and their family members into Eunice’s will during this interval. In essence, they redirected her initial will intent to UBS, Gunster and their favor. Eunice had a long awaited phone conversation with Herb Mallard asking him to help her from UBS and their collaborators. Mallard was to meet with Eunice but somehow Eunice tragically died the day before they were to meet. The documents we will disclose will be appalling to the readership.

EUNICE & BOBBY GARDINER AT PALM BEACH RED CROSS BALL

UBS LOOSES IN USA COURT ON RETALIATION AND DISCRIMINATION AGAINST WOMEN

Wikipedia reports: “UBS lost the high profile case Zubulake v. UBS (Warburg,217 F.R.D. 309 [S.D.N.Y. 2003] United States District Court Judge Shira A. Scheindlin presiding), a discrimination and retaliation suit. The plaintiff Laura Zubulake, a former institutional equities saleswoman at the company’s Stamford office, alleged her manager, Mathew Chapin, had undermined and removed her from professional responsibilities, excluded her from business outings, belittled her to colleagues and generally treated her different from the men on her desk. Also, she alleged that there were several sexist policies in place, such as entertaining clients at strip clubs that made it difficult for women to foster business contacts with clients.” A4 It can be said UBS has a serious problem with women. Reliable UBS sources say this behavior is endemic and see no reason for it to end. How can any UBS female client believe she and her estate will be treated any differently? How did Eunice Gardiner get involved with UBS just before her death? What happened to Eunice’s estate. We will tell the chilling story.

UBS CAUSING USA REIGN OF TERROR WITH IMPUNITY

New York Times speaking of UBS says: “The bank’s (UBS) recidivism seems rivaled only by its ability to escape prosecution.” A5 What must Congress do to stop the criminal shift of USA elderly estates to UBS with the aiding and abetting of Obama/Holder immunity policy? UBS is setting up a criminal culture within the legal and financial advising communities within the USA to a level never seen before in the USA. Why should not the honest mimic the dishonest ?

UBS Offshore Wire Transfer to UBS AG (Switzerland)

UBS MAKES “FED FUND WIRE” OF UBS CLIENT ASSETS TO UBS AG (SWITZERLAND) WITHOUT MANDATORY USA IRS OR CLIENT WRITTEN AUTHORIZATION

We have a clear violation of USA Federal law by UBS in moving Client Mallard’s assets to Switzerland without Client Mallard’s knowledge or consent. As with other UBS Clients UBS will not disclose the whereabouts of the assets. Gallingly, UBS denies the above document exists. UBS can deny the undeniable since UBS has AG Holder immunity from prosecution. An alerted Attorney General Eric Holder’s office will take no action against UBS.

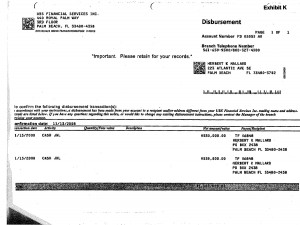

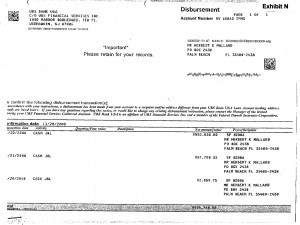

Shifting Cash Transfers But UBS Client Mallard Never Received Them

UBS DISAPPEARS CLIENT ASSETS WITHOUT MANDATORY CLIENT WRITTEN CONSENT

These two documents clearly show UBS “Disbursement” of UBS Client Mallard assets but UBS will not tell there whereabouts. Again, UBS denies the existence of these documents. UBS does not need accountability since UBS has AG Holder immunity from prosecution.

WHERE IS THE APPROXIMATELY $147,000,000 ROBERT LION GARDINER ESTATE?

UBS has teamed up with a highly controversial Florida law firm known for looting elderly estates. Among other things, Gunster Yoakley lost a case against the Gannett heirs having to pay more than $1,000,000 in damages for looting their Father’s estate. At the very same time Gunster was allegedly preparing to loot the Gardiner Island Family’s estate worth approximately $147,000,000. UBS has continued their reign of terror by allegedly forging documents of elderly Eunice Gardiner in furtherance of the scheme. From information and belief, Gunster may be able to piggyback upon AG Holder’s UBS immunity from USA prosecution.

UBS OBAMA BUNDLER ROBERT WOLF IN EPICENTER OF MEDIA

New York Times reports: “Mr. Wolf, who is 50, golfs and vacations with Mr. Obama and is known for e-mailing friends photos of himself with the president. … it has been making other UBS executives uneasy of late. … Yet the contretemps within UBS may be more about office politics than national politics. … Several executives, most notably Robert McCann, have been jockeying for a bigger role in running the bank. … Largely through his relationship with the president (Obama), Mr. Wolf has become the public face of UBS in the United States … (Wolf) makes more than $5 million a year, according to several people briefed on the matter.” A6 UBS has been a largest backer of Obama for years. UBS received the sought after grand prize of immunity from USA Federal prosecution when Obama became USA President. This is why UBS is so aggressive in their recruitment of Palm Beach area elderly. Once recruited through devious documents, the elderly are entrapped and subject to UBS manipulations diminishing their estate. The UBS documents will be disclosed.

UBS Chairmen Axel A. Weber, Robert Wolf and Robert J McCann

WILL SWISS UBS EVER LOOSE IT’S USA CHARTER?

ABC News reports: “In court documents, federal prosecutors say UBS bankers helped set up many of the secret accounts in Liechtenstein and, overall, hid as much $20 billion belonging to US citizens. … UBS is extremely vulnerable to losing their license in the US.” A7 We cannot see how UBS will be allowed to continue doing business within the United States considering the contents of this newsletter, irrefutable future documented disclosures. UBS violated their US Federal criminal parole (United States of America v UBS AG, Case 09-60033-CR-Cohn, Miami, Florida) with more than 23 additional major US Federal criminal violations. We now find Attorney General Eric Holder and his Lanny Brueur assistant are personally is on record saying the Justice Department will take no action against UBS meaning Holder has granted UBS immunity from USA prosecution. We now have UBS AG (Switzerland) Chairman and University of Chicago professor Axel Weber being allowed to keep the USA Charter after defending UBS AG Libor criminal violations before a Congressional hearing. Reliable UBS sources say UBS AG Chairman Weber is allegedly secretly involved in the planned University of Chicago Obama Presidential Library. A reliable UBS source says UBS Geneva allegedly has an alleged secret Obama Presidential Library+ numbered account for foreign donations. Is Obama obligated under the USA law to report these opaque offshore transactions? Does Obama have a plausibility of denial readied whereby others will be blamed for the “misstep” when exposed?

PALM BEACH GUNSTER/HANLEY LAWYER SAYS NO KICKBACK!

Orlando Sentinel reports: “Heirs to the Gannett fortune say a law firm improperly put one of its clients in charge of their father’s estate. Frank and Charles McAdam III are suing attorney Daniel Hanley and his West Palm Beach law firm, Gunster, Yoakley & Stewart. The brothers say the law firm wrongly let J.P. Morgan Trust Co. handle the estate of Charles McAdam Jr. Louis Mrachek, who is representing Hanley and the law firm, said his client did not funnel work to J.P. Morgan as some kind of kickback.” A8 Hanley, Gunster Yoakley Law, UBS were committing relatively the same dubious acts to the Gardiner Island Family’s estate at the same time they were defending their Gannett violations. Hanley/Gunster continue to be successful at violating Florida laws, with alacrity. It is apparent Hanley/Gunster have no respect in the Florida judicial system, for some reason.

Daniel A Hanley Gunster, Yoakley & Stewart lawyer

JUDGE POLEN SAYS GUNSTER DIMINISHED ESTATE LEGACY

Law.Com reports: “A unanimous panel of the 4th District Court of Appeal upheld a $1 million legal malpractice judgment against the law firm Gunster Yoakley & Stewart awarded to the heirs of the Gannett newspaper fortune. … two sons sued Gunster, shareholder Daniel A. Hanley and JP Morgan for breach of fiduciary duty, constructive fraud, civil conspiracy and unjust enrichment. … Judge Mark E. Polen, said the ‘plaintiffs showed that their father’s intent, as expressed in his will, was frustrated by the negligence of Gunster Yoakley and that, as a direct result of such negligence, their legacy was diminished.’ ” A9 We are supplying documents so there will no need of an investigation into Gunster/UBS behavior, just prosecution.

BANKER PLEADS GUILTY IN USA FEDERAL COURT TO EMBEZZLING ELDERLY CLIENT MONEY

USA Attorney’s office reports: “Adorean Boleancu pleaded guilty in a $1.8 Million Fraud Scheme case. Boleancu, vice president and senior financial consultant in the Wealth Management Group …, admitted to writing more than $1.8 million in checks on accounts of an elderly, widowed client for his personal benefit. He signed the victim’s name to checks drawn on the victim’s brokerage account and home equity lines of credit without the victim’s knowledge or authorization. The checks were payable to Boleancu’s family members, his girlfriend, another female acquaintance, cash, and financial companies where Boleancu had credit card accounts.” A10

GUNSTER YOAKLEY & STEWART BOCA CHAMBER OF COMMERCE PRESS RELEASE!

Greater Boca Raton Chamber of Commerce Gunster press release says: “Gunster, Florida’s law firm for business, is pleased to announce that 43 Shareholders from South Florida, have been named to The Best Lawyers in America® 2013. Best Lawyers conducts extensive peer-review surveys in which tens of thousands of leading lawyers confidentially evaluate their peers. The number of attorneys at the firm who were named as Best Lawyers increased by more than 70% percent in the last year and more than one half of Gunster’s Shareholders were named to the list. Many were named in multiple categories.” A11 Many USA businesses self advertise to recruit new clients.

Daniel A Hanley Gunster, Yoakley & Stewart lawyer

FLORIDA SUPREME COURT: “LAWYER + DISHONESTY AS CLIENT PERSONAL REPRESENTATIVE AND TRUSTEE = DISBARMENT”

Florida Probate & Trust Litigation reports: “Dishonesty. It’s an ugly charge that’s implicit (and sometimes explicit) in practically every case involving fiduciary misconduct by a personal representative (PR) or trustee. For most defendants the “what’s-your-worst-day-in-court” calculus for this kind of case is usually a dollars and cents exercise: on your worst day in court, what’s the largest money judgment you’re looking at? For lawyers serving as PR’s or trustees the stakes are potentially much higher: your worst day in court could be a professional death sentence: disbarment.” A12 At this time no Gunster lawyer has been disbarred, including Daniel A Hanley. Hanley has allegedly gone on to commit worse in the probate of Eunice Gardiner.

FLORIDA BAR HOTLINE

For individuals who are unsure if a lawyer has acted ethically or who are dissatisfied and wish to consider whether filing a complaint may be appropriate, The Florida Bar operates the Attorney Consumer Assistance Program (ACAP). ACAP staff, including attorneys, handle complaints and may be able to resolve problems before a complaint is filed. The ACAP telephone number is toll-free: 1-866-352-0707

___________________________________________

Letters to the Editor:

This is first issue hence no letters, yet.

___________________________________________

Dear Readership:

Gunster Yoakley & Stewart teaming up with UBS will allegedly rapidly further the depletion of Florida elderly estates. As was mentioned, Attorney General Holder and his assistant Brueur are on record giving UBS immunity from USA Federal prosecution. Gunster/UBS should be able to reap large amounts of elderly assets without fear, unless USA Congress drags UBS AG (Switzerland) Chairman Axel Weber into a repeat begging hearing performance to gain USA Charter continuance. UBS Chairman McCann is ready for the inevitable with an Irish passport supplanting his USA passport, just in case. If Raoul Weil squeals it is all over for UBS in USA. After all, UBS Chairman Raoul Weil is responsible for initiating the UBS criminal network within the USA. What will then happen to Obama’s alleged fuzzy UBS Swiss numbered accounts for foreign Obama Presidential library+ donations?

Gunster Yoakley Daniel A Hanley lawyer has other elderly in progress after the alleged Gardiner Island Family caper. There is an elderly Jupiter Island, Florida woman, an elderly Palm Beach woman both being plied at this time. We are watching.

Our reliable UBS sources have reported the UBS scheme has elderly clients sign single page contracts. UBS later gives them several books of complex material to read. Within these books are convoluted fine print statements by UBS saying UBS allegedly has unilateral control over UBS client transactions. In essence, UBS can do what it wants with their estate. It is allegedly common for the UBS client assets to be unilaterally diverted via offshore wire transfers and/or shifted without US Federal mandatory reporting. Another UBS scenario is when UBS unilaterally invests in controversial offshore companies with little to no mandatory US Federal reporting. UBS then tells the client all of the account asset investments were lost without any accountability. In every instance investigated researchers have found UBS ignores mandatory account asset transfer information USA Federal IRS compliance. It is fruitless for the UBS client to take legal action or report the criminal behavior to UBS Federal IRS because USA Attorney General has given UBS immunity from prosecution. The researchers and other UBS reliable sources continue to send revealing corroborated UBS information. We are creating a cost effective investigation for Congressional oversight. UBS is on the USA Congressional radar.

We have been told by reliable USA Government sources that USA Federal careerists are urging us on by attempting to block any transparency retaliation. We have nothing but high regard for USA Federal careerists constantly intimidated by political appointees to do favors for high value presidential donors. From the USA military to IRS upper echelons there is disgust at what is happening within the Obama administration. We have seen honorable careerists purged, quit or be otherwise vilified. We just report documented incidences.

We thank our reliable sources as well as our careerist fans within the USA Federal Government.

info@seniorsavior.com